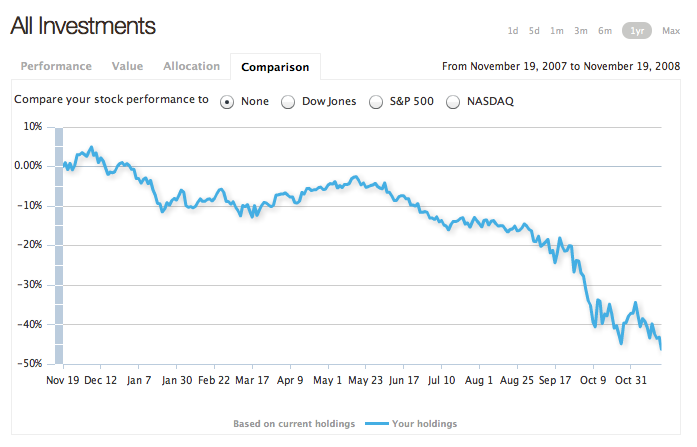

You know that really awesome Leona Lewis song, “Bleeding Love”? Well, I keep bleedin’, keep keep bleedin’ out my 401k!

A few months ago, I wrote a post talking about this supposed recession and how I had yet to see any real signs of something they had been talking about for months already…

Well, here is your sign:

(BTW, I get these nifty charts from Mint.com which is the coolest, best finance application out there (beats quicken and money) … And it’s free!)

So… hmm… I wonder when the <bagel> started… My guess would be somewhere around Sept 1? Or at least that’s when we finally had our come-to-Jesus moment and realized the emperor really didn’t have any clothes on. (That poor emperor just keeps getting nakeder and nakeder.)

So far I’m incurring my biggest losses on an international fund, which invests in overseas companies. At the beginning of this year, I believed that whole ‘decoupling’ thing… that exports would improve and other countries would grow quicker as the dollar got weaker, and how the world economy wasn’t tied to the American economy.

I guess I was wrong.

So, any professionals out there wanna tell me what to do now? Do I move anything around, or is it best to just keep everything where it is?

I think I’m just gonna stay where I am and ride this puppy out. The good news is that every contribution to my 401k now is buying more and more shares (I’d up my contribution if I could), and when the uptick happens (and yes, it will happen), I’ll be sitting pretty.

What I do feel bad about is for those who are less than 5 years away from retirement. Not a lot of time to regain pre-plummet values…

Yes, my friends… the bagel is here!!!

I’m not a financial professional, HOWEVER, I have just been through several very intense finance classes for my MBA…and here’s what I’m doing.

Nothing. I’m keeping my contributions the same, I’m not moving my money around. I’m not doing jack. The economy will eventually turn around, and your investments will also turn around. I joke all the time that my 401k is now a 201k, but the reality is that, I’m well diversified, I’m buying additional shares on the CHEAP, and when the turnaround happens in a couple of years, I’ll have far more shares than I would have if I had stopped buying entirely. And if my shares go up $5/share, it’ll be much better for me if I’ve got 1000 shares than it would be if I only had 100.

I’m not even worried about any of my funds going bankrupt. I know what each of my funds carries, and each of my funds is will diversified–carrying a wide array of stocks and bonds. For any of my funds to go bankrupts, pretty much every single one of the major companies in the US and abroad would have to go under entirely. Remember, this financial crisis is the crisis of banks and confidence, not the entire economy. Despite getting ridiculed for it, McCain was correct when he said the fundamentals of our economy are strong…they are. It’s just going to take us a while to get rid of all the high-risk, high-flying dumbheads who left the fundamentals behind in their quest to make a quick buck at someone else’s expense.

Don’t forget, you and I, we’ve got at least another 35-37 years in the workplace…if not significantly more. The economy will go up and down a WHOLE bunch over that time. As long as you’re not putting all of your retirement funds into only one or two places (especially stocks), then just ride it out.

Remember, I’m NOT a financial professional. Just a very interested amateur. 🙂

Thanks Matt… also if anyone out there has any tips on good financial blogs, especially for 20-somethings, post them!

All of the financial advice/blogs/websites out there seem geared toward the 50-something crowd, which is cool, cause they’re the ones with all the cash… but everyone says ‘start young’… well here I am… been starting now for 5 years. Don’t have enough assets yet for any finacial planners to be interested in me, so I turn to the web… where is the advice for li’l ole’ me?

1. Our good friend works for the church in the finance dept. He had a meeting about a month a go with the first prez and after the entire report on all the church’s investments and etc. The financial guy/friend was told to “do nothing and continue on as is” in regards to the church’s financial plans and investments.

2. You have LOTS AND LOTS OF TIME. Around the time you and I were born people were declaring that our generation would never own their own homes and maybe not even cars because of the 22% interest rates, and insane gas prices. Look at us now, we are of the highest percentage generations of home ownership.

3. There are so many ups and downs that it’s impossible to tell what’s around the corner.

4. QUIT WORRYING! There’s nothing you can do about it, so just smile and ride it out. Hubby and I haven’t checked our balances once, and we are in very good spirits lately 🙂

PS I really love that Leona Lewis song!

Yummy looking bagel…

From where I sit…..I don’t worry at all….The Good Lord knew I couldn’t handle much money, so he blessed me to the extent not to have much. I have sufficent for my needs…..yup…

Buy low, sell high. Apparently that is the fundamental rule of the stock market. We are just strapping in and holding on for dear life, hoping to survive this economic rollercoaster. John even wants to invest more… I think he must be a little crazy. Of course, he did marry me so he definitely is!